Sf property tax rate

Sections 5411 and 5415 Memoranda. Review the shipping information and sign on the SF waybill.

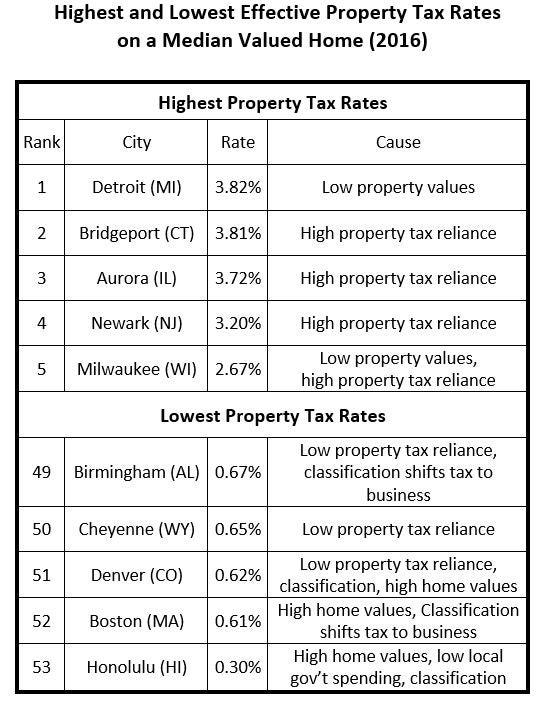

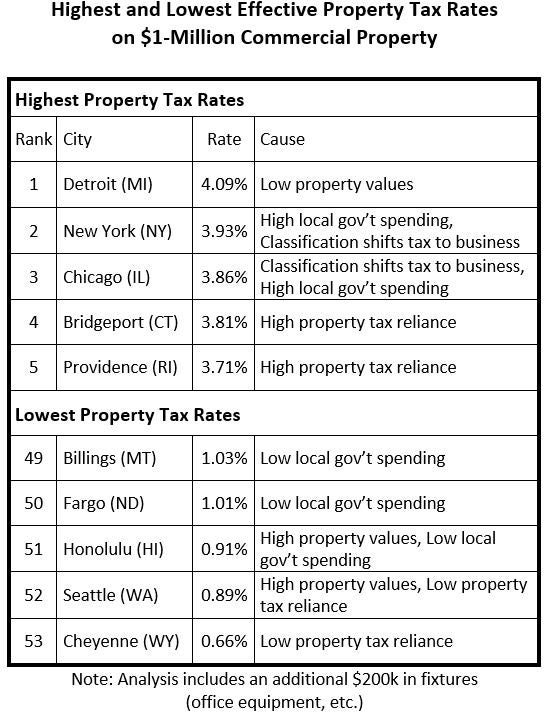

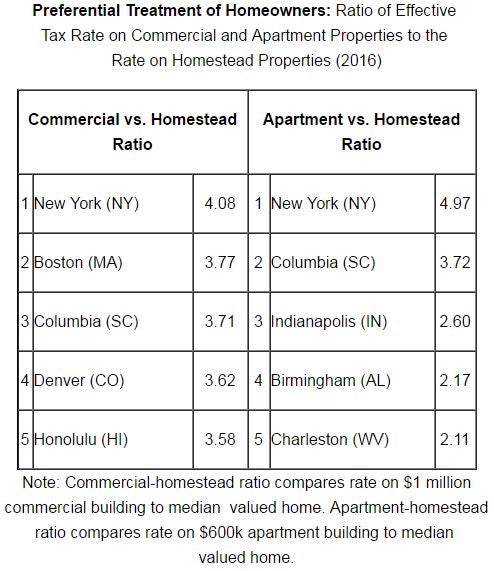

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Business Personal Property Taxes.

. Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations. These state taxes include things like. What does this mean for high-tax states like New York New Jersey or Connecticut.

State and local income tax sales taxes personal property tax and homeowner property taxes. For the fiscal year 2018-2019 the San Francisco property tax rate is 11630 percent. Even though the taxes get paid in arrears it is customary for the buyers to prepay property taxes in escrow.

Well it could mean that more people. SF 1444 - Request for Authorization of Additional Classification and Rate - Renewed - 612022. This is the date all taxable property and tax rolls are certified for collection to the Tax Collector.

This article will go line-by-line through the Form 1116. TSB-M-83 17S Taxable Status of Leasehold Improvements For or By Tenants Publications. The exact tax rates depend on the location of the property in the Philippines.

Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts. Both spouses must have lived in the house for two of the five years. State Tax Exempt Forms.

On June 6 1978 California voters approved Proposition 13 an amendment to the Californias Constitution that rolled back most local real property assessments to 1975 market value levels and limited the property tax rate to 1 percent plus the rate necessary to fund local voter-approved bonded indebtedness. Secured property taxes are calculated based on real propertys assessed value as determined annually by the Office of the Assessor-Recorder. For tax year 2021 you can no longer deduct for state and local taxes in excess of 10000.

Per 1000 RevTax Code Per 1000 General Law PropertyValue Sec 11911-11929 PropertyValue or Chartered City Rate County Rate Total ALAMEDA COUNTY 110 110 ALAMEDA Chartered 1200 110 1310 ALBANY Chartered 1500 110 1610 BERKELEY Chartered 15 for up to. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year. The City began making the transition to a Gross Receipts Tax from a Payroll Tax based on wages paid to employees in 2014.

SF 1413 - Statement and Acknowledgment - Renewed - 612022. Check your email and print the attached Neighbour Express or UPS label SF Waybill and Commercial Invoice. They raise your property tax rate slightly but only by a fraction of a percent.

SF This is a list of standard government forms that start with the letters SF. The tax is calculated as a percentage of total payroll expense based on the tax rate for the year. The Office of the Assessor-Recorder.

The real property tax rates in the Philippines are discussed in Section 233 of the Local Government Code of 1991. Pack your shipping item properly place the signed SF waybill and Commercial Invoice inside of the package and attach the Neighbour Express or UPS label. The Standard Forms 424 SF-424 Form Families represent the government-wide standard data sets and forms for grant application packages which were developed in partnership with federal grant-making agencies and the applicant community.

United States Tax Exemption Form. GSA-FAR 48 CFR. Sections 1101b4 1105c3 and 1105c5 Regulations.

An individual claiming a foreign tax credit must attach Internal Revenue Service IRS Form 1116 Foreign Tax Credit to his or her tax return. The secured property tax rate for Fiscal Year 2021-22 is 118248499Secured Property Tax bills are mailed in October. California City Documentary and Property Transfer Tax Rates Governance.

Request for Authorization of Additional Classification and Rate - Renewed - 612022. Otherwise you have to take the smaller exclusion. Of living space 3 bedrooms and 25.

Where to find property taxes plus how to estimate property taxes. For more details about creating Grantsgov forms please review the Forms Request page. References and other useful information.

If youre married and file a joint return you may be able to exclude 500000. The SF Assessor will ask you to. The real property tax rate for Metro Manila Philippines is 2 of the assessed value of the property while the provincial rate is 1.

SF 1424 - Inventory Disposal Report - Revised - 7202022. The Final Tax Roll is the 1st certification of the tax rolls by the Value Adjustment Board per Florida Statute 1931222 FS. Publication 862 Sales and Use Tax Classifications of Capital Improvements and Repairs to Real Property Bulletins.

This gorgeous home sits across from a greenbelt park and offers 1585 sf. SF 1413 - Statement and Acknowledgment - Renewed - 612022.

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

Understanding California S Property Taxes

Understanding California S Property Taxes

Sf Property Tax Rate Over Time

Understanding California S Property Taxes

2022 Property Taxes By State Report Propertyshark

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Property Taxes By State Embrace Higher Property Taxes

Understanding California S Property Taxes

Secured Property Taxes Treasurer Tax Collector

Understanding California S Property Taxes

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom